The HSA market has grown rapidly since its inception in 2004, garnering comparisons to the early 401(k) market which has exceeded $5 trillion in assets according to the Investment Company Institute1. In the most recent 2017 Midyear Devenir HSA Research Report we provide guidance that growth in the HSA market is unlikely to slow any time soon. As part of our continuing effort to inform investors about HSAs, we will be posting a three-part blog series comparing HSAs to 401(k)s for use as a retirement savings vehicle. While the two accounts are often compared at a high level, we take an in-depth look at the benefits and limitations of each account highlighting three reasons investing in an HSA is more nuanced than it’s 401(k) counter-part.

Reason 1: HSAs are flexible.

HSAs have unique traits that make them effective tools for accountholders with a variety of objectives. To begin with, tax efficiency and investment capabilities differentiate HSAs, but other factors like the lack of a “use it or lose it” limitation as opposed to an FSA, and current employment portability as opposed to a 401(k) set HSAs apart as a powerful lifetime health-retirement vehicle. To illustrate the primary uses of HSAs, it’s useful to think about accountholders as falling into 1 of 3 profiles:

- Spenders typically use their HSA for current expenses not covered by their health plan. This type of accountholder uses the HSA much like an FSA but without the “use it or lose it” limitation imposed on FSAs.

- Savers defer to saving their HSA for future expenses and some may choose to invest beyond the interest earned on their account.

- Investors typically invest their HSA dollars to fund healthcare in retirement.

The table below shows some of the qualities associated with each account profile2:

Figure 1:

| Profile | Target Health Cost Coverage | Deposit Account Use | Primary Features Used | Estimated % of Accounts |

|---|---|---|---|---|

| Spenders | Current | Yes | Debit Card / Online Banking | 64% |

| Savers | Future | Yes | Online Banking / Investment Account | 26% |

| Investors | Retirement | Yes | Investment Account | 10% |

Note: According to Devenir Research, a typical HSA investor maintains more than twice the deposit account balance of a spender and twice as much as the minimum required to invest.

For healthy individuals and families, paying for current health expenses out of pocket lets investors pursue the full benefits of an HSA. Paying out of pocket allows their HSA balance to grow tax-free and (with some careful recordkeeping) they may reimburse themselves for health care expenses in the future. There are no required minimum distributions (RMD) either, so accountholders may choose to leave their HSA funds invested for as long as they want. In comparison, 401(k)s are limited to use as a retirement savings vehicle, and while contributions are tax-deductible, distributions are required when you reach the age of 70 ½ and may be taxed as income. HSA funds are neither taxed, nor penalized, so long as distributions are used for qualified medical expenses (QME). After age 65, they can also be used for expenses other than QME without penalty, however distributions for non-QME will be taxed as income.

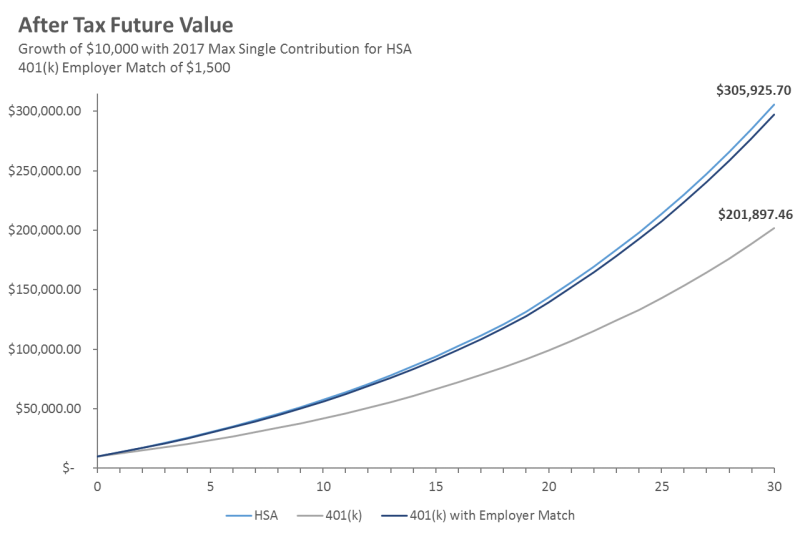

Given the multiple uses of HSAs, accountholders should consider whether they plan to use their account for current or future expenses and if they plan to invest, as this may affect an investor’s time horizon and/or risk tolerance. We believe HSAs are at their best when the full tax benefits associated with investing are being utilized. To show the effectiveness of investing within an HSA we calculated the after-tax future value of an HSA compared to a 401(k), with and without, an employer match using the research framework provided by Dr. Greg Geisler in his analysis of HSAs. Dr. Geisler’s findings earned him recognition from the Journal of Financial Planning when he received the Montgomery-Warschauer award for his contribution to financial planning. In his findings, Dr. Geisler suggests an order in which to contribute to various accounts3:

“first, contribute the maximum to an HSA and contribute enough to a 401(k) to get the maximum employer match; if money is still available, next, pay down high-interest-rate debts; if money is still available, next, contribute to a 529 account if it produces state income tax savings and if funding future higher education costs of a loved one is important; and, if money is still available, contribute the maximum allowed for the year to unmatched retirement accounts.”

Consistent with Geisler’s research, our analysis in Figure 2 demonstrates that HSAs can provide more value over time than a 401(k) when accounting for taxes.

Figure 2:

This added value was $8,367 over a 30-year investment horizon. This is a considerable gap as the 401(k) employer match is just under 50% of the HSA contribution at $1,500 in this scenario. Additional plan specific considerations such as vesting restrictions in 401(k) plans and any employer contributions to an HSA may affect the take home pay associated with contributing to each account as well.

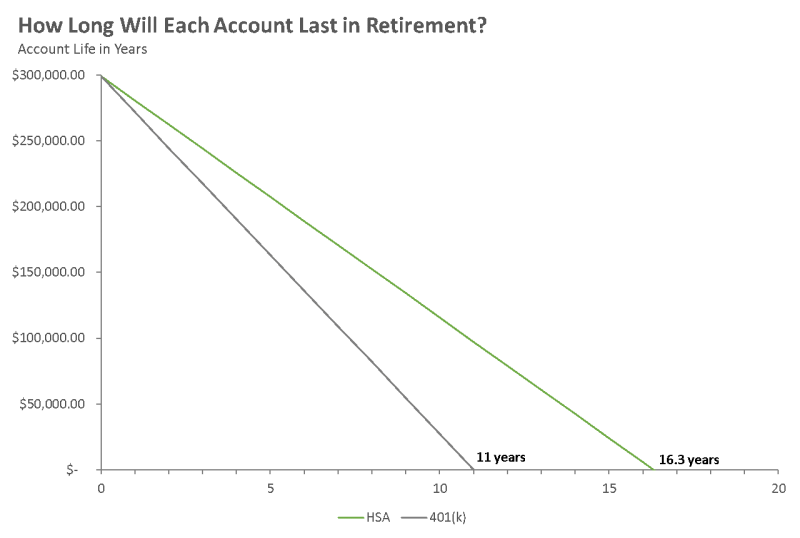

To further illustrate the potential impact an HSA can have on healthcare savings, we forecasted how long each account could pay for healthcare in retirement, assuming a $300,000 balance, 15-year retirement and $275,000 in health expenses as provided in Fidelity’s most recent estimate4.

Figure 3:

In our analysis HSAs outlasted 401(k)s after-tax by 5.3 years5 when used for healthcare expenses in retirement, and it was the only account that lasted through the full length of retirement. It’s clear that when compared to a 401(k), the benefits of tax-favored investing in an HSA make it hard to ignore as a viable part of the retirement conversation. For those who can afford to pay current medical expenses out of pocket, HSAs may offer a way to add value to their retirement portfolio.

Stay tuned to the Devenir Blog for parts 2 and 3 in the series!

Investments are not FDIC Insured and may lose value. The information above is intended to be used for educational purposes only and is not to be construed as investment or tax advice, or as tailored to any specific investor. Consult a financial advisor or tax professional for more information. This information may be affected by the laws of particular states and there is no guarantee this information will be consistent across all states. Alabama, California, and New Jersey may impose taxes on HSA contributions, earnings, and dividends. Additionally, New Hampshire may impose taxes on HSA contributions.

End Notes

1 Sources: Investment Company Institute, Federal Reserve Board, and Department of Labor.

2 Source: 2017 Devenir Midyear HSA Research Report.

3 Geisler: “This assumes distributions from the HSA are for QMEs. If an HSA distribution is taken after reaching age 65 but it is not for reimbursement of QMEs, the entire distribution is subject to income tax. In such case, the ATFV formula becomes the same as investment model 2 in Table 1 (the tax deferred retirement account), and contributing to an HSA moves from the first or second recommendation to the fifth recommendation. Part of this hierarchy is adapted from Geisler (2006)”.

4 Estimate based on a hypothetical couple retiring in 2017, 65-years-old, with life expectancies that align with Society of Actuaries’ RP-2014 Healthy Annuitant rates with Mortality Improvements Scale MP-2016. Estimates may be more or less depending on actual health status, area of residence, and longevity. Estimate is net of taxes. The Fidelity Retiree Health Care Costs Estimate assumes individuals do not have employer-provided retiree health care coverage, but do qualify for the federal government’s insurance program, Original Medicare. The calculation takes into account cost-sharing provisions (such as deductibles and coinsurance) associated with Medicare Part A and Part B (inpatient and outpatient medical insurance). It also considers Medicare Part D (prescription drug coverage) premiums and out-of-pocket costs, as well as certain services excluded by Original Medicare. The estimate does not include other health-related expenses, such as over-the-counter medications, most dental services and long-term care.

5 Assumes all distributions will be made for qualified medical expenses (QME).

Citations

Geisler, Greg. 2016. “Could a Health Savings Account Be Better than an Employer-Matched 401(k)?” Journal of Financial Planning 29 (1): 40–48.

https://www.onefpa.org/journal/Pages/JAN16-Could-a-Health-Savings-Account-Be-Better-than-an-Employer-Matched-401(k).aspx

Greg Geisler’s research shows HSAs could provide benefits over 401(k)s. Sara Bell. UMSL. (7/28/2017)

https://blogs.umsl.edu/news/2017/07/28/greg-geisler/