Due to the transactional nature of health savings accounts, HSA providers often require accountholders to maintain a certain balance in cash before allowing them to invest. HSA providers often attach incentives to satisfy the threshold requirement as well, such as waiving fees, often at a higher threshold, or providing access to investment options (limiting access if the threshold is not met). The structure of threshold requirements varies significantly across providers due to differing philosophies and strategies. Below are some of the methods providers use to differentiate their threshold from others in the marketplace:

- Balance requirement ($ value): What specific dollar value is required, and do investors have access to investments if the balance is not large enough?

- Threshold benefit (fee waiver/access to investments): What is the incentive for satisfying the threshold?

- Money Movement: If deposits fall below the threshold can money be moved to investments or are investors required to maintain the threshold in order to add to investments?

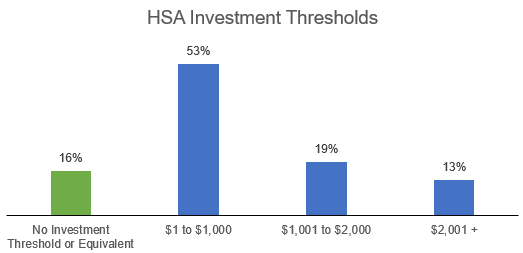

We have found most HSA providers have a threshold balance requirement between $1 and $1,000.

Source: Devenir Research

Some accountholders looking to invest may prefer no threshold at all, while others may benefit from a cash requirement. For example, many providers issue debit cards to family members associated with an HSA. If the family invests their HSA for long term expenses, a minimum cash balance ensures that family members have access to cash needed for current medical expenses without having to sell investments at a potentially undesirable time. Minimums can help ensure accountholders have some liquidity during market gyrations, especially for smaller balance accounts and those at higher risk to incur medical costs. However, for those who do not expect to need their balance for many years, a cash requirement can be a drag on total returns. As we noted in our previous blog post, deposit rates in HSAs remain low and are unlikely to make up for potential investment return.

Investments are not FDIC Insured and may lose value. The information above is intended to be used for educational purposes only and is not to be construed as investment or tax advice, or as tailored to any specific investor. Consult a financial advisor or tax professional for more information. Data used may be estimates and may not reflect actual observed data.