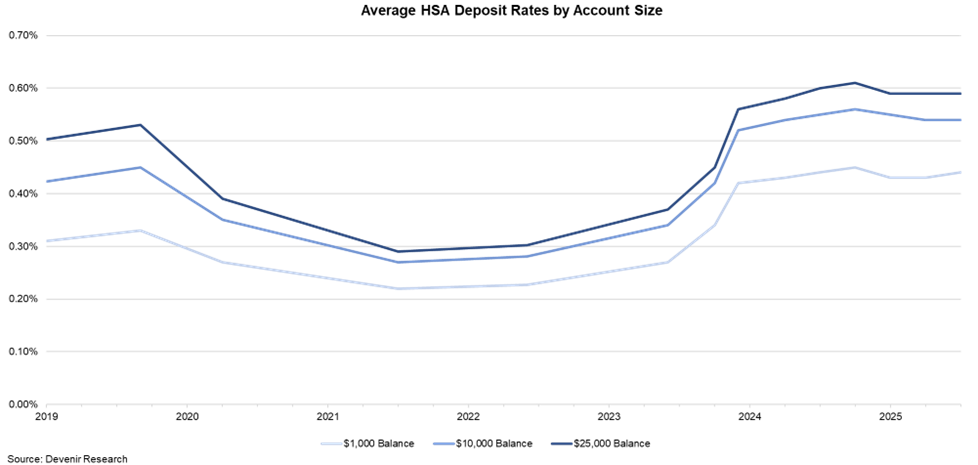

Over the past quarter, data collected from HSA Search displayed HSA deposit rates remaining at their current levels. The exception to this was the $1,000 balance. The $1,000 balance ticked up slightly from 0.43% to 0.44% in Q2. Rates appear to have stabilized over the last couple of quarters with a slight decrease to the $10,000 balance in Q1 and a slight increase to the $1,000 balance in Q2.

The Fed kept rates unchanged during Q2 2025, which aligned with HSA deposit rate trends. The Effective Federal Funds Rate (EFFR) remained at 4.33%1. This is lower than the long-term average of 4.61% but continues to be elevated prior to the Federal Reserve’s rate hiking cycle started back in 2022. HSA providers are likely to hold deposit rates in conjunction with the Federal Reserve’s outlook unless the economy drastically changes.

However, HSA providers will continue to monitor their deposit rates for several reasons — attracting new account holders, staying competitive for existing account holders, fluctuating funding costs, and as the Fed’s policies evolve. For employers and account holders, this means paying closer attention to rate updates, particularly as economic conditions remain fluid.

Note: The above reflects Devenir’s summary of publicly available data. We encourage readers to confirm specific rates with individual HSA providers, as offerings can differ significantly and change without notice.

References

- Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EFFR, July 1, 2025