MINNEAPOLIS — According to the 14th semi-annual Health Savings Account (HSA) survey and resulting research report conducted by Devenir, HSAs have grown to an estimated $42.7 billion in assets and 21 million accounts as of June 30, 2017.

The survey was conducted in July 2017 and reflected data from primarily top 100 HSA providers in the country. All data was requested for the period ending on June 30th, 2017.

Key Findings from the 2017 Midyear Devenir HSA Survey and resulting research report:

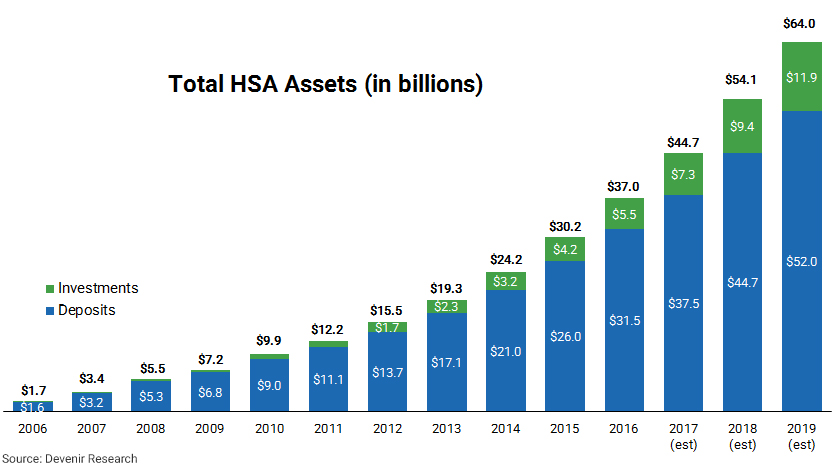

- Strong HSA asset growth. The number of HSA accounts surpassed 21 million, holding about $42.7 billion in assets, a year over year increase of 23% for HSA assets and 16% for accounts for the period of June 30th, 2016 to June 30th, 2017.

- HSA investments see substantial growth. HSA investment assets reached an estimated $6.8 billion in June, up 44% year over year. The average investment account holder has a $15,146 average total balance (deposit and investment account).

- Unfunded accounts come down. Less HSAs (20 percent) were unfunded halfway through 2017, compared to 24 percent at the end of 2016.

- Health plans remain the largest driver of account growth. Health plan partnerships continued as the leading driver of new account growth, accounting for 36% of new accounts opened in 2017 so far.

“We continue to see impressive HSA growth, especially amongst those HSA assets held in investments as consumers begin to understand how HSAs can help them save for both their current and future healthcare expenses,” said Jon Robb, senior vice president of research and technology at Devenir.

Devenir currently projects that the HSA market will exceed $60 billion in HSA assets held amongst nearly 30 million accounts by the end of 2019.

Click here to view the Executive Summary

Projections derived from 2017 Midyear Devenir HSA survey, press releases, previous market research, and market growth rates. Projections are barring any regulatory or market environment changes.

Forward-looking statements are based on current expectations and assumptions based on historical growth, the economy, other future conditions and forecasts of future events, circumstances and results.

About Devenir

Devenir is a national leader in providing customized investment solutions for HSAs and the consumer directed health care market. When health savings accounts first emerged in 2004, Devenir built its expertise around delivering cutting-edge investment solutions. As the consumer driven health care industry grew, so did Devenir’s reputation as a leading researcher and award-winning investment consultant. Today, Devenir continues to lead the way in the rapidly growing HSA market. A research driven perspective makes Devenir the go-to investment advisor, HSA investment platform and consultant to employers, banks, third party administrators, health plans and technology providers. Learn more at devenir.com

Contact

Devenir

Eric Remjeske

952-446-7400

[email protected]