MINNEAPOLIS — Devenir, a national leader in customized investment solutions for Health Savings Accounts (HSAs), released today the results of its 12th semi-annual Midyear HSA Survey, which showed HSAs have grown to an estimated $34.7 billion in assets and 18.2 million accounts for the period ending June 30, 2016.

The survey was conducted in July 2016 and reflected data from primarily Top 100 HSA providers in the country. Recent data reflects a consistent growth trend for spending accounts and a shift toward a savings mindset for health care consumers.

“We are seeing consistent growth in new HSA accounts at a growth rate in excess of 20 percent year over year and we expect that to continue for the next couple of years,” said Jon Robb, senior vice president of research and technology at Devenir.

Key findings from the Devenir 2016 Midyear HSA Survey and resulting research report include:

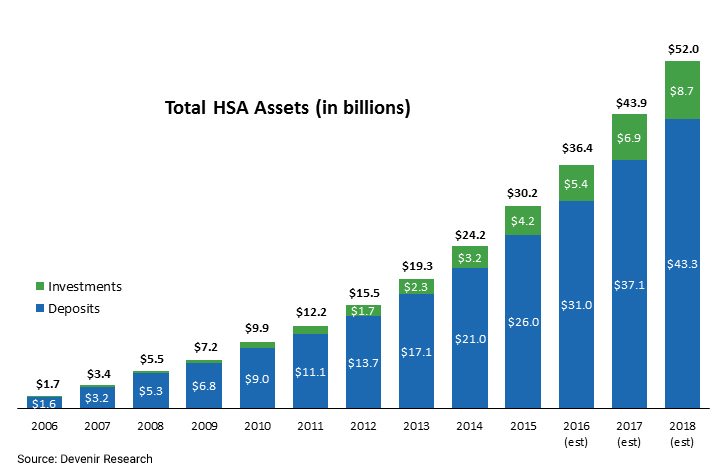

- HSA assets surpass $34 billion threshold. The number of HSAs increased to 18.2 million. The value of the accounts exceeded $34.7 billion in assets, which represents a year-over-year increase of 22 percent for HSA assets and 25 percent for accounts for the period of June 30, 2015 to June 30, 2016.

- Fewer unfunded accounts. Fewer HSAs (20 percent) were unfunded in the first half of 2016, compared to 24 percent at year-end 2015.

- HSA investments continue to grow. HSA investment assets reached an estimated $4.7 billion in June; a 23 percent, year-over-year increase. The average HSA investment account holder had a $15,092 total balance (HSA deposit and investment account combined).

- Health plans remain the largest driver of account growth. Health plan partnerships continued to be the primary driver of HSA growth, accounting for 37 percent of new accounts opened so far in 2016.

“As health coverage continues to become more consumer oriented, individuals are becoming more engaged and invested in managing their health and their health care dollars,” said Eric Remjeske, president and co-founder, Devenir.

Devenir projects that, by the end of 2018, the HSA market will likely exceed $50 billion in HSA assets covering over 27 million accounts.

Click here to view the Executive Summary

Projections derived from 2016 Midyear Devenir HSA survey, press releases, previous market research, and market growth rates. Projections are barring any regulatory or market environment changes.

Forward-looking statements are based on current expectations and assumptions based on historical growth, the economy, other future conditions and forecasts of future events, circumstances and results.

About Devenir

Devenir is a national leader in providing customized investment solutions for HSAs and the consumer directed health care market. When health savings accounts first emerged in 2004, Devenir built its expertise around delivering cutting-edge investment solutions. As the consumer driven health care industry grew, so did Devenir’s reputation as a leading researcher and award-winning investment consultant. Today, Devenir continues to lead the way in the rapidly growing HSA market. A research driven perspective makes Devenir the go-to investment advisor, HSA investment platform and consultant to employers, banks, third party administrators, health plans and technology providers. Learn more at devenir.com

Contact

Devenir

Eric Remjeske

952-446-7400

[email protected]