Devenir midyear report reveals 46% of Health Savings Account assets now held in investments, with 4 million accounts investing

MINNEAPOLIS, MN – October 9, 2025 – Health Savings Accounts (HSAs) reached $159 billion in assets across 40 million accounts at midyear 2025, marking 16% year-over-year asset growth, according to the 30th semi-annual market survey from Devenir, the leading investment solutions provider powering HSA programs nationwide.

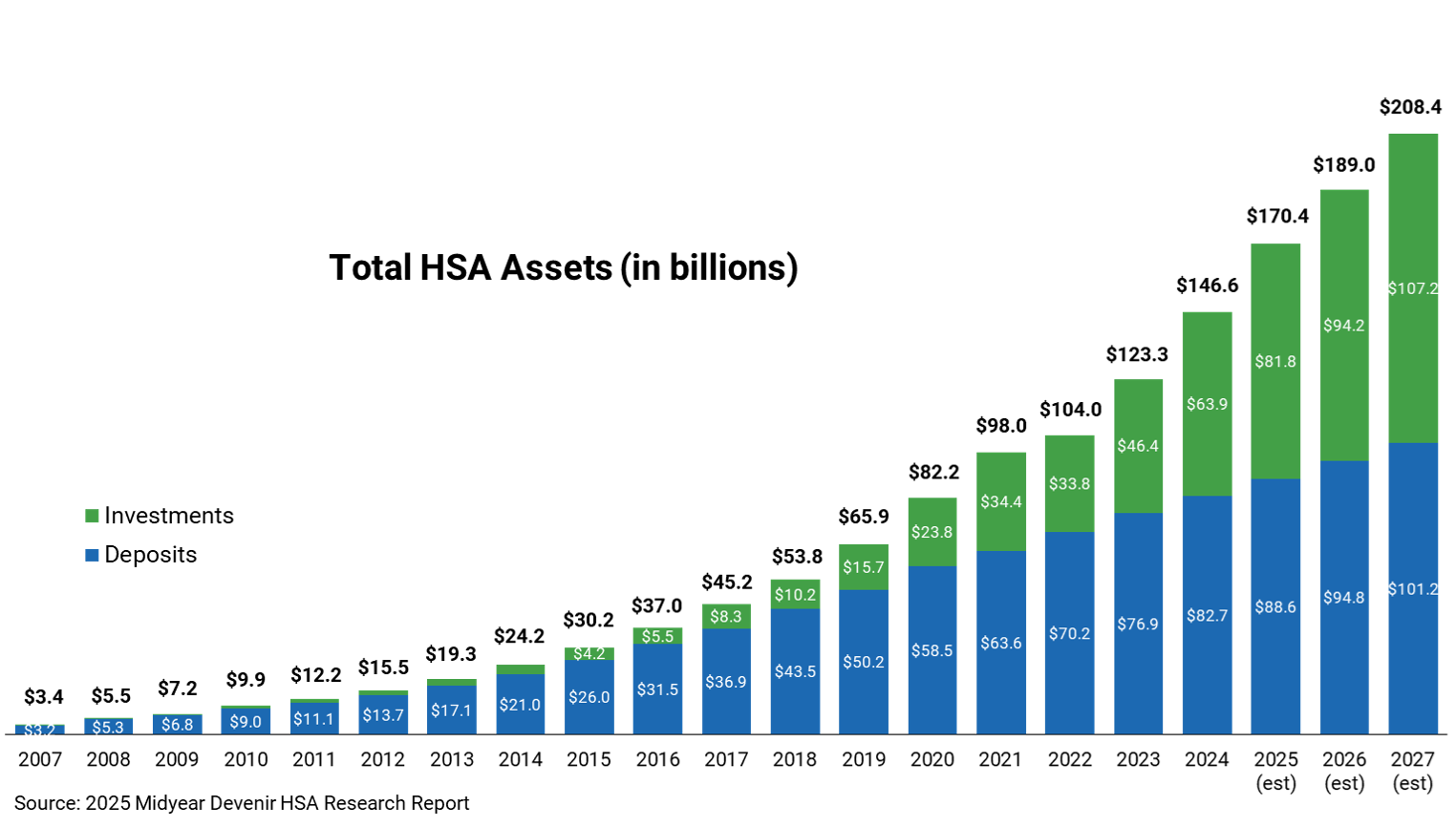

Investment assets drove the expansion, rising 30% year-over-year to $73 billion. Investment assets now represent 46% of all HSA assets. The 4 million accounts holding investments grew 23% year-over-year, with these account holders averaging $22,635 in combined deposits and investments, nine times the $2,469 average of funded deposit-only accounts.

“HSAs saw strong growth in the first half of 2025, driven by steady contributions and market gains,” said Jon Robb, SVP, Research & Technology at Devenir. “More account holders are choosing to invest, while many households still use HSAs for current medical costs. That dual role, both spending account and long-term savings vehicle, continues to drive the popularity and growth of HSAs.”

Key findings from the Devenir 2025 Midyear HSA Survey and resulting research report:

- Market momentum amplifies asset growth. Supported by favorable markets, HSA assets expanded meaningfully in the first half of 2025. By midyear, assets reached nearly $159 billion across about 40 million accounts, up 16% year-over-year for assets and 6% for accounts.

- Investment assets climb to record levels. Investment balances benefited from strong market returns and growing recognition of HSAs’ long-term advantages. At midyear 2025, investment assets rose to nearly $73 billion, a 30% year-over-year increase.

- Steady expansion in investing. About 4 million HSAs, roughly 10% of all accounts, held at least some of their HSA dollars in investments. The number of investing accounts was up 23% year-over-year.

- Withdrawals grew faster than contributions. In the first half of 2025, contributions totaled over $33 billion (up 6% year-over-year) and withdrawals totaled almost $23 billion (up 11% year-over-year).

Devenir projects the HSA market will surpass 47 million accounts and exceed $208 billion in total assets by the end of 2027.

Forward-looking statements are based on current expectations and assumptions derived from the 2025 Midyear Devenir HSA survey and other sources. They are subject to risks and uncertainties that could cause actual results to differ materially from those projected.

Methodology

Data comes from Devenir’s semi-annual HSA Market Survey, collected from HSA providers for the period ending June 30, 2025. Survey responses are self-reported and verified through multiple sources where available.

Devenir

Since the inception of Health Savings Accounts, Devenir has specialized in delivering robust, tailored investment solutions. Our pioneering research and innovative tools have established us as a trusted authority within the consumer-driven healthcare market. Today, Devenir is the preferred investment solutions provider for financial institutions, administrators, banks, and healthcare technology providers. Our deep market expertise and commitment to innovation empower our partners and their account holders.

Learn more about our research and solutions at devenir.com.

Media Contact

Devenir

Eric Remjeske

952-446-7400

[email protected]