The majority of this report was derived from the 2020 Year-End Devenir HSA Market Survey. This survey was conducted to shed light on the rapidly growing and evolving health savings account market. The survey was carried out in January 2021, and primarily consisted of top 100 providers in the health savings account market. All data was requested for the period ending on December 31st, 2020.

Key Findings

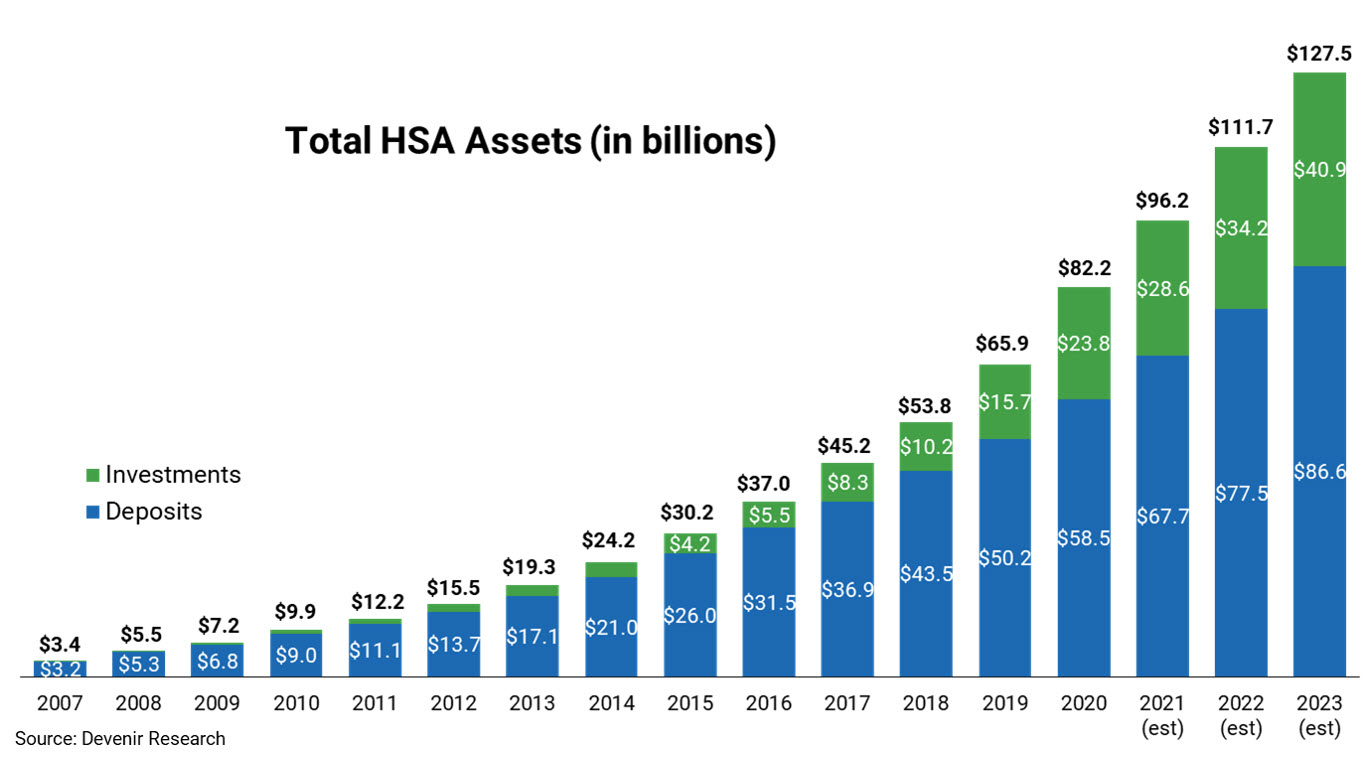

- Robust HSA asset growth. Health savings account asset growth remained strong, increasing to $82.2 billion in assets held in over 30 million accounts, a year-over-year increase of 25% for assets and 6% for health savings accounts for the period ended December 31st, 2020.

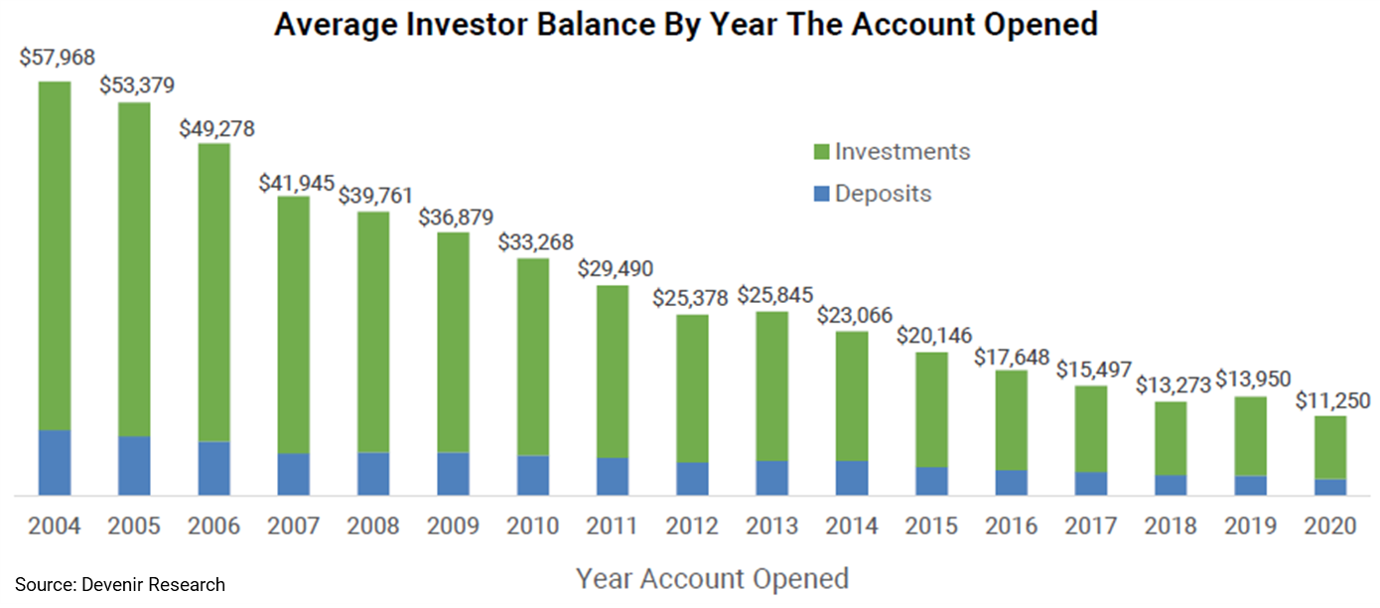

- HSA investment asset growth soars. Fueled by strong market gains in the second half of 2020, HSA investment assets soared to an estimated $23.8 billion at the end of December, up 52% year-over-year. On average, investment account holders hold a $17,926 total balance (deposits and investments combined).

- Interest in HSA investing grows. There are now approximately 1.7 million accounts that are investing a portion of their HSA dollars, representing almost 6% of all accounts.

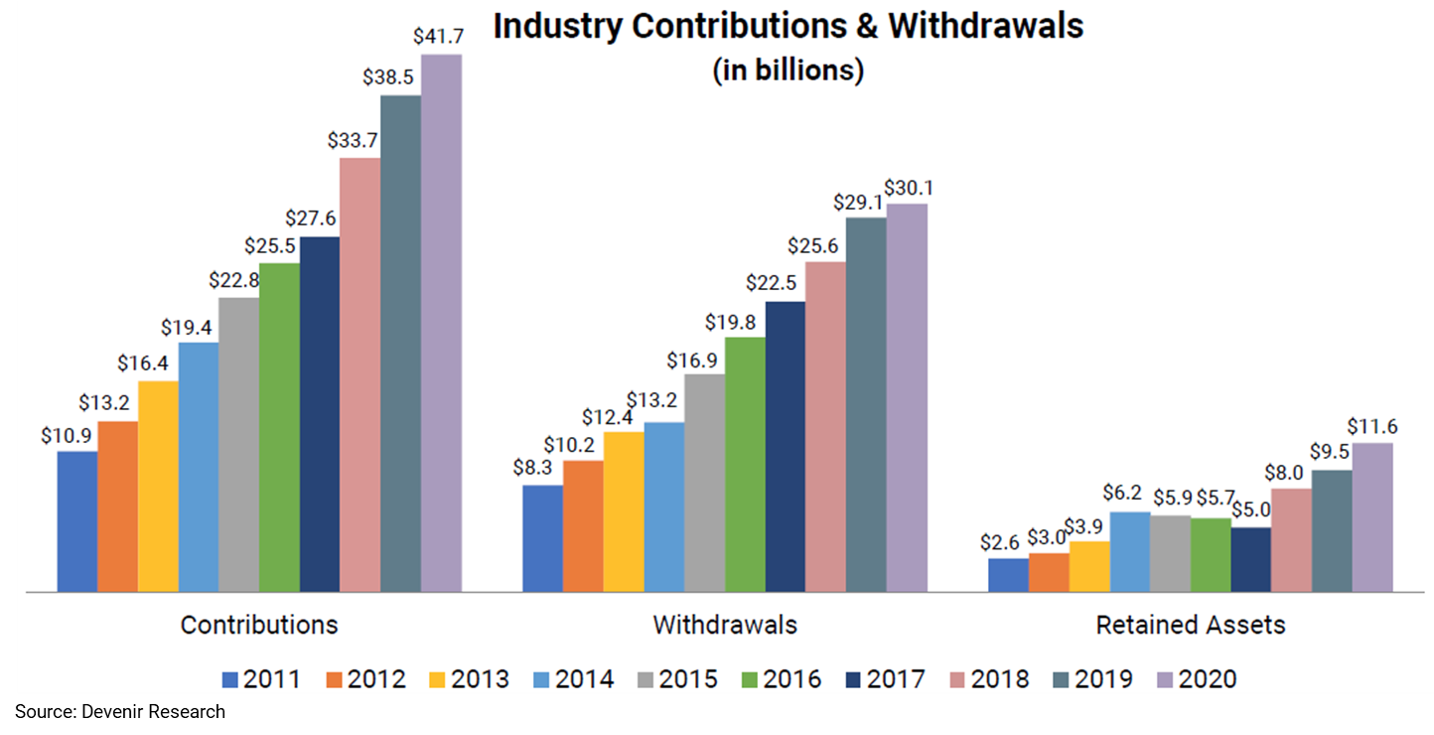

- HSA contribution growth outpaces withdrawals. Account holders contributed almost $42 billion to their accounts in 2020 (up 8% from year prior) and withdrew over $30 billion from their accounts in 2020 (up 4% from year prior).

Devenir currently projects that the HSA market will exceed 36 million accounts by the end of 2023, holding over $127 billion in assets.