The majority of this report was derived from the 2025 Midyear Devenir HSA Market Survey. This survey was conducted to shed light on the rapidly growing and evolving Health Savings Account (HSA) market. The survey was carried out in summer of 2025, with data requested for the period ending on June 30th, 2025.

Key Findings

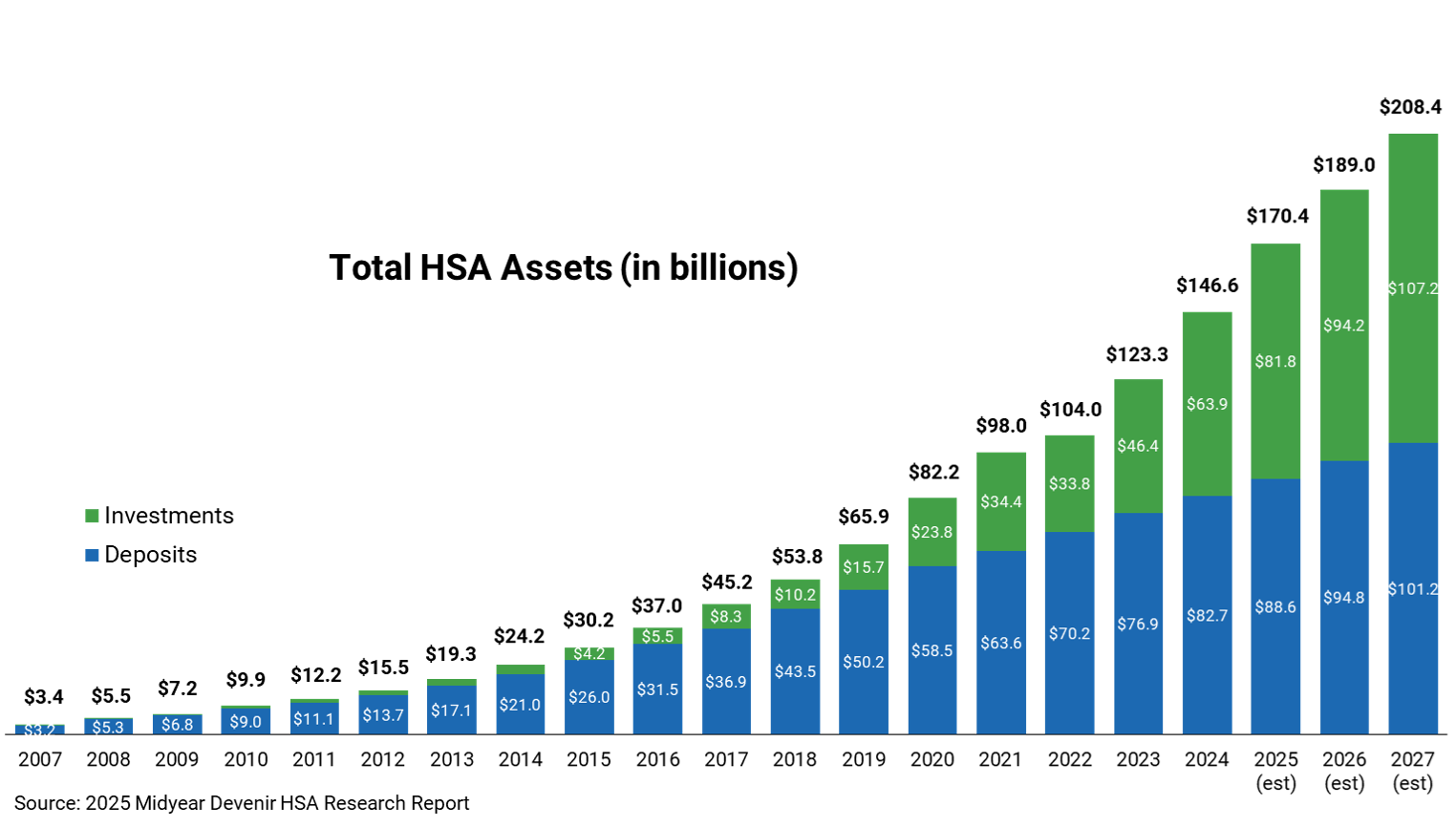

- Market momentum amplifies asset growth. Supported by favorable markets, HSA assets expanded meaningfully in the first half of 2025. By midyear, assets reached nearly $159 billion across about 40 million accounts, up 16% year-over-year for assets and 6% for accounts..

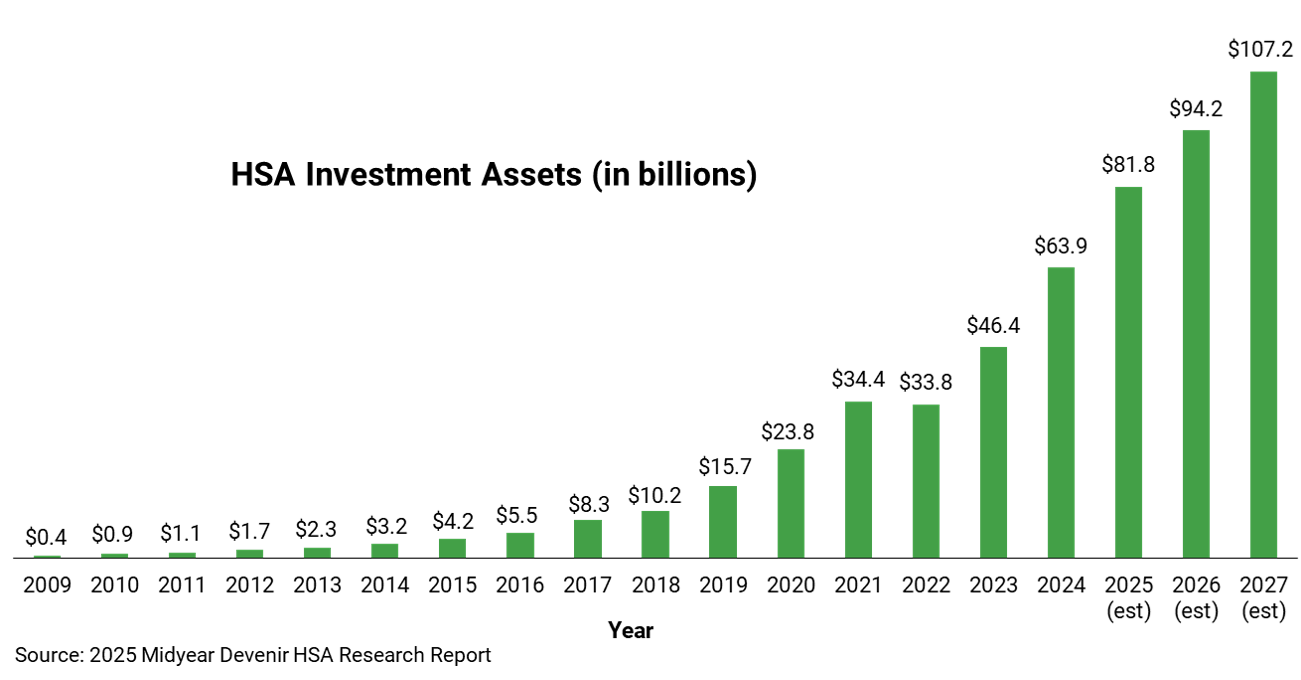

- Investment assets climb to record levels. Investment balances benefited from strong market returns and growing recognition of HSAs’ long-term advantages. At midyear 2025, investment assets rose to nearly $73 billion, a 30% year-over-year increase.

- Steady expansion in investing. About 4 million HSAs, roughly 10% of all accounts, held at least some of their HSA dollars in investments. The number of investing accounts was up 23% year-over-year.

- Withdrawals grew faster than contributions. In the first half of 2025, contributions totaled over $33 billion (up 6% year-over-year) and withdrawals totaled almost $23 billion (up 11% year-over-year).

Devenir projects the HSA market will surpass 47 million accounts and exceed $208 billion in total assets by the end of 2027.