The majority of this report was derived from the 2018 Midyear Devenir HSA Market Survey. This survey was conducted in order to shed light on the rapidly growing and evolving health savings account market. The survey was carried out in July, 2018 and primarily consisted of top 100 HSA providers in the health savings account market. All data was requested for the period ending on June 30th, 2018.

Key Findings

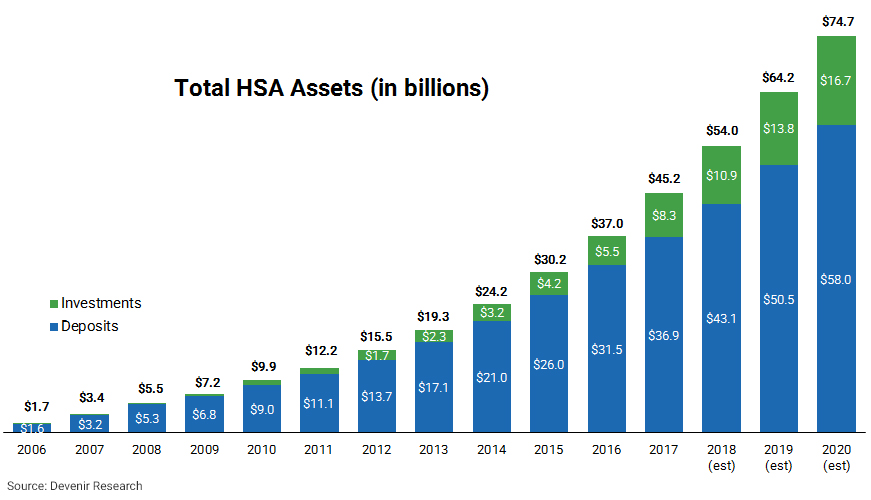

- HSA assets exceed $50 billion. HSA consumers had accumulated $51.4 billion in their HSA at the end of June, a year over year increase of 20.4%. Devenir expects this number to grow to $54 billion by the end of 2018.

- Steady account growth. The total number of HSAs grew to 23.4 million at the end of June, up 11.2% from a year ago. The account growth in the first half of 2018 was in-line with recent years. Overall, accounts grew by 5.2% in the first half of 2018, compared with 5.0% in 2017, 8.5% in 2016, and 5.5% in 2015.

- HSA investment assets approach $10 billion. Backed by a strong market, HSA investment assets reached an estimated $9.8 billion at the end of June, up 45% year over year. The average investment account holder has a $16,007 average total balance (deposit and investment account).

- Fewer unfunded accounts. Less HSAs (15%) were unfunded at the midway point of 2018 compared to 20% at the same time in 2017.

- Employer relationships are the largest driver of account growth. Direct employer relationships are the leading driver of new account growth, accounting for 42% of new accounts opened in the first half of 2018.

Devenir projects that, by the end of 2020, the HSA market will approach $75 billion in HSA assets covering more than 29 million accounts.