Note: Alliant Credit Union’s HSA business transitioned to HealthEquity during Q4-2017.

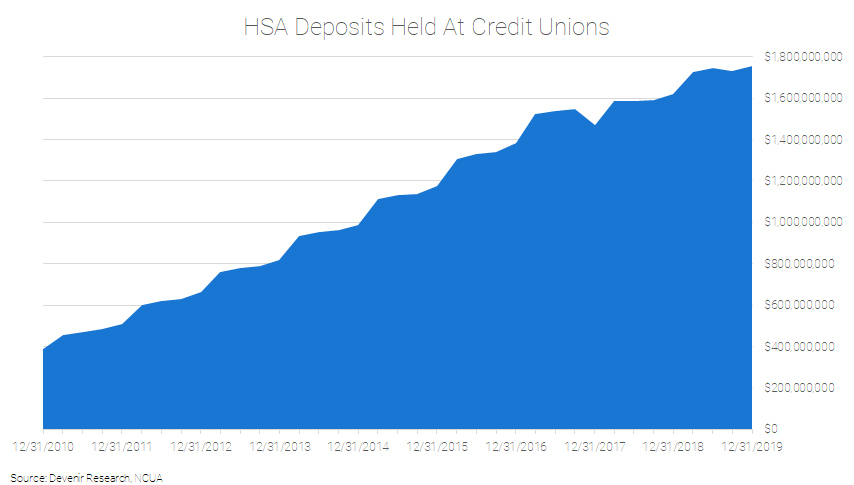

On March 5th we published our latest quarterly analysis of how health savings accounts are faring among credit unions. According to the latest NCUA filings, at the end of 2019 credit unions held $1.76 billion in HSA deposits among roughly 700,000 accounts.

Note: Alliant Credit Union’s HSA business transitioned to HealthEquity during Q4-2017.

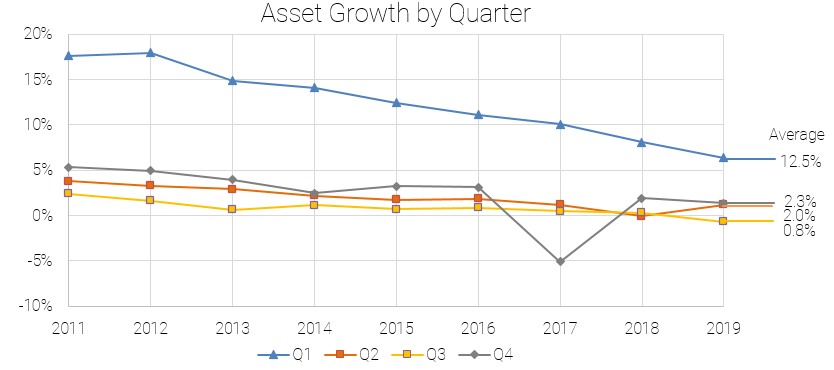

HSA asset growth continues to be cyclical with employers often contributing to their employees’ accounts during the first quarter of the year. The growth seen during the first quarter of 2019 accounts for about 77% of total HSA asset growth at credit unions during that year. The average percent of total growth seen in the first quarter since 2011 is 66%.

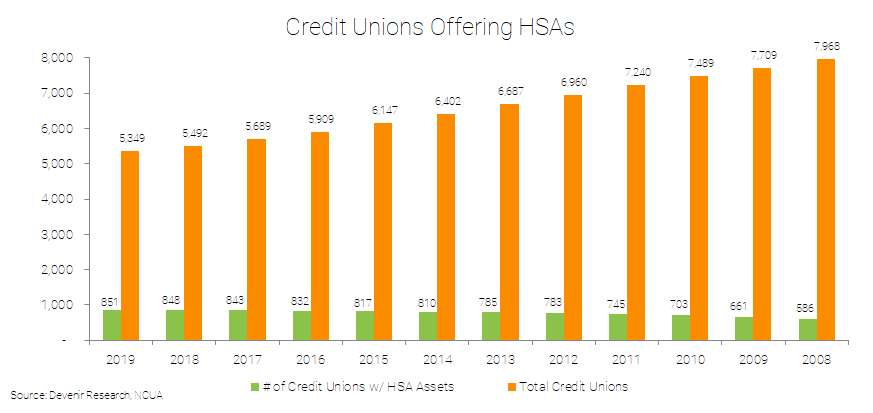

There were a few more credit unions offering a health savings account product in 2019, while the total number of credit unions overall continued to decline.

Of the 851 credit unions with health savings account deposits, 73 of them held over $5 million in HSA assets.

| Number of NCUA Credit Unions With… | |

|---|---|

| Over $5 Million in HSA Deposits: | 73 |

| Over $1 Million in HSA Deposits: | 249 |

| Over $500,000 in HSA Deposits: | 357 |

| With HSA Deposits: | 851 |

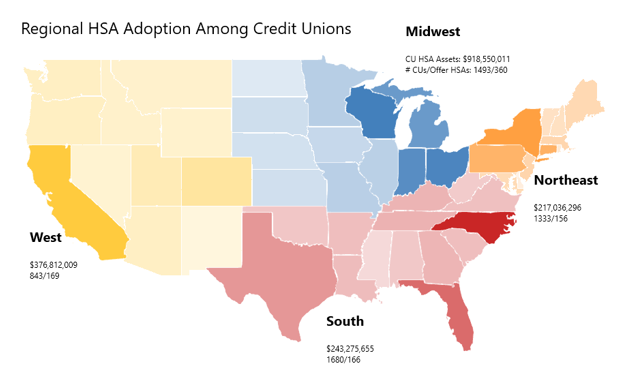

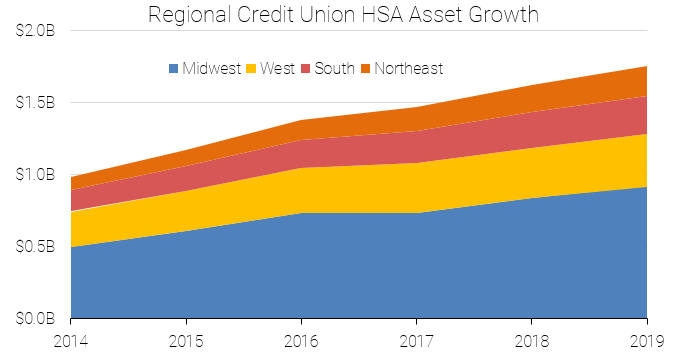

We continue to see regional HSA trends among credit unions. The Midwest has the largest amount of HSA assets in the country among credit unions. Two states that saw the greatest increase in credit union HSA assets were Wisconsin and Ohio. Wisconsin saw an increase of $23 million (12%), while Ohio saw an increase of $22 million (12%). By region, the states with the largest increases were Wisconsin with $23 million (Midwest), North Carolina with $10 million (South), Utah with $4 million (West), and New York with $5 million (Northeast).

We remain interested in the adoption of health savings accounts at credit unions and will continue to examine NCUA quarterly filings. Thank you for reading, and feel free to reach out to our research team at [email protected] if you have any questions or thought’s you’d like to share!