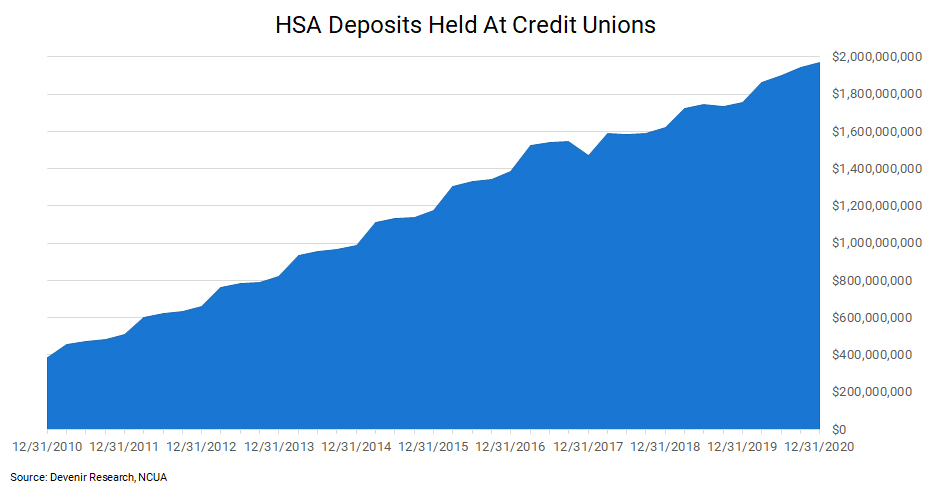

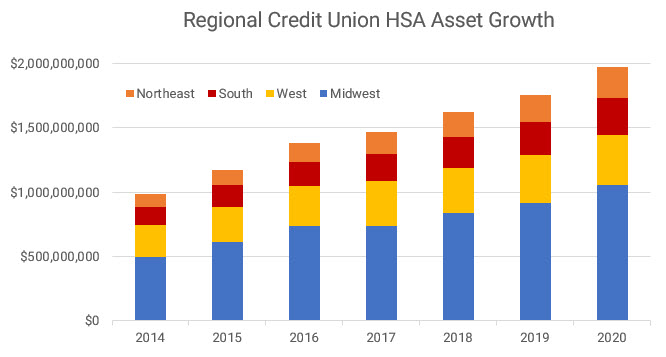

On March 11th we published our latest quarterly analysis of how health savings accounts are faring among credit unions. According to the latest NCUA filings, at the end of 2020 credit unions held $1.97 billion in HSA deposits among roughly 695,000 accounts.

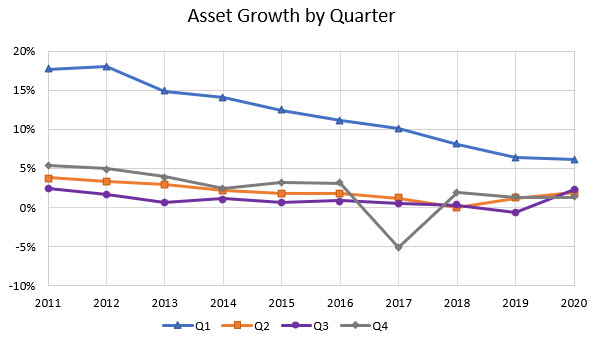

Note: Alliant Credit Union’s HSA business transitioned to HealthEquity during Q4-2017.

We continue to see some seasonality in asset growth with the first quarter of the year averaging 11.9% since 2011, followed by low single-digits growth on average for the remainder of the year. The growth in assets seen within the first quarter of 2020 accounted for about 50% of the total asset growth for the year. This higher growth rate in the first quarter could be associated with employer groups funding employee’s HSAs at the beginning of the year. However, we have seen the average growth occurring in Q1 slow over time.

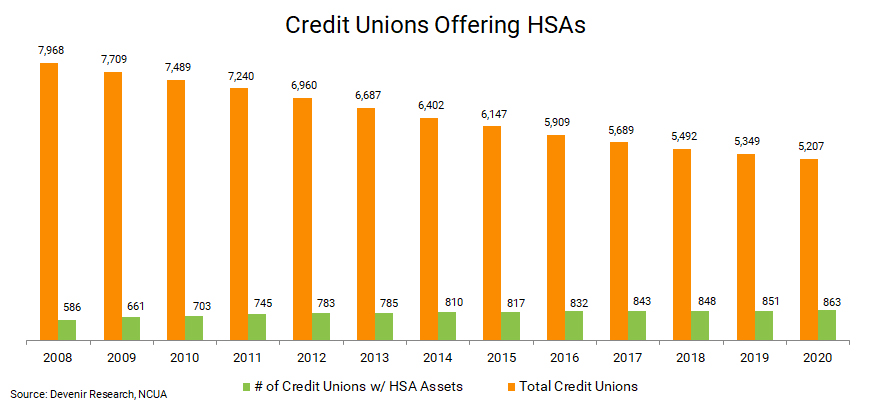

The number of credit unions that offer a health savings account continues to grow incrementally while the total number of credit unions decreases over time.

At the end of 2020, 863 credit unions held HSA assets. Of those 863 credit unions, 79 had over $5 million in HSA deposit assets.

| Number of NCUA Credit Unions With… | |

|---|---|

| Over $5 Million in HSA Deposits: | 79 |

| Over $1 Million in HSA Deposits: | 272 |

| Over $500,000 in HSA Deposits: | 373 |

| Below $500,000 in HSA Deposits: | 139 |

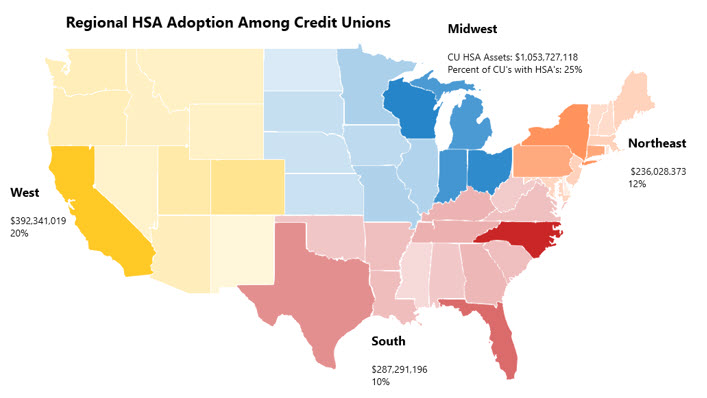

HSA adoption among credit unions continues to show strong regional trends. The Midwest leads the U.S., passing the billion-dollar milestone for total HSA assets at credit unions while no other region has passed the $400 million asset mark. The Midwest holds approximately 53% of all HSA assets within credit unions and Wisconsin holds about 23% of the total assets in that region. California has almost 51% of the West’s total credit union HSA assets and North Carolina has the highest percentage in the South with almost 38% of the region’s total HSA assets. In the Northeast, New York has about 29% of the region’s total credit union HSA assets.

Devenir will continue to monitor health savings account adoption within credit unions by monitoring NCUA quarterly data. If you have any comments or questions, feel free to contact our research team at [email protected]. To see more HSA related research and content, subscribe to our monthly newsletter.