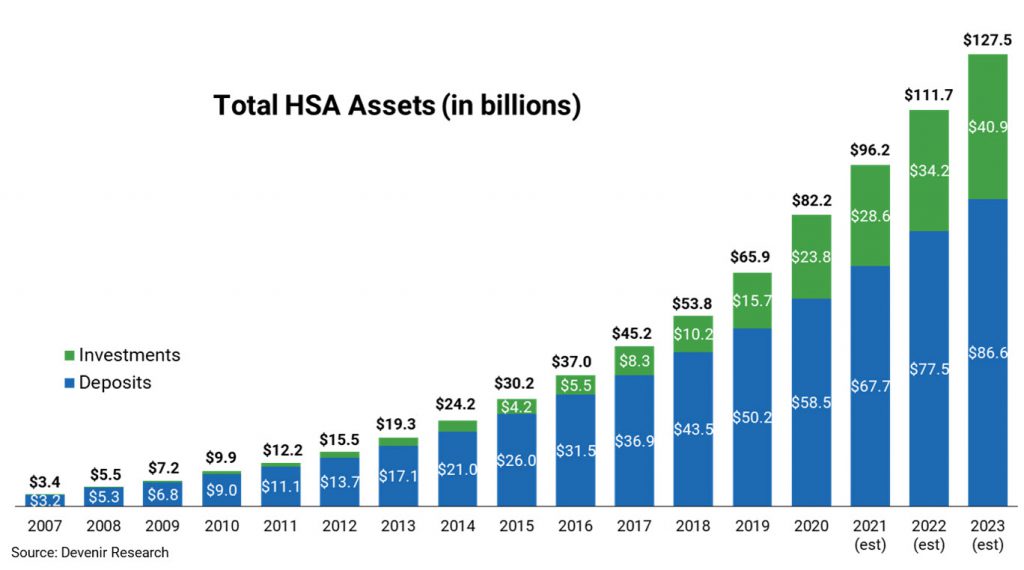

HSA investments have grown rapidly in recent years, as more account holders invest and existing investors grow their balances. At the end of 2020 nearly $24 billion dollars were invested, accounting for roughly 29% of total HSA assets (up from 24% at the end of 2019).

The share of overall HSA assets in investments increased sharply in 2020, largely due to strong investment returns and a growing emphasis on investments among HSA providers. We project investments to continue to make up a greater share of HSA assets, reaching an estimated 30% by the end of 2021. Several factors driving this trend include increasing awareness of the ability to invest HSA dollars, greater adoption of investment-first HSA plan design, and continued saving by existing investors. We believe this trend may continue as an increase in saving coupled with a decrease in spending has pushed deposit balances higher in 2020, resulting in potential for excess balances to be invested. Low deposit interest rates (relative to historical comparisons) also create an incentive to invest for account holders looking to potentially earn a higher return on their HSA balance.

The HSA Investment Accountholder

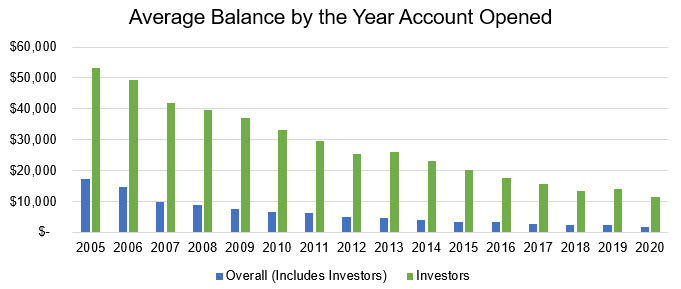

HSA investors have become an increasingly important subset of account holders for providers due to their higher balances and prospects for future growth. The population of existing investors make up a small but growing 6% share of all accounts (just over 7% of funded accounts), however they hold an average total HSA balance of $17,975, well above the non-investor industry average of $2,737.

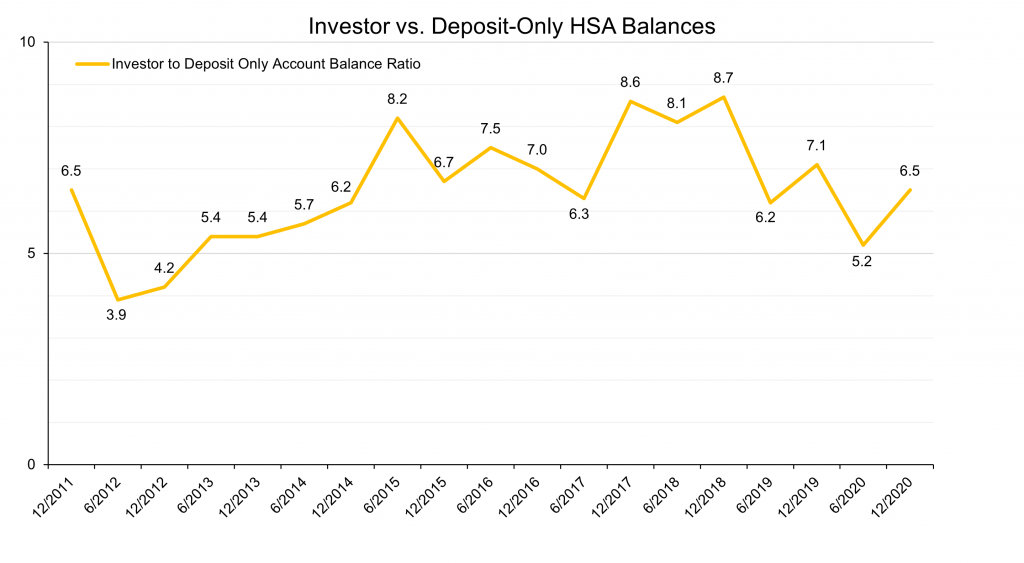

In addition to holding larger overall balances, investors tend to hold greater deposit balances than non-investors. Investors had a combined balance (investments + deposits) 6.5x greater than funded deposit-only accounts on average at the end of 2020.

As investments continue to make up a greater share of overall HSA assets, HSA investors will grow increasingly important to providers looking to maximize account holder outcomes.