Open enrollment is approaching, and that means most employers will be reviewing their health benefits for 2020. Those offering an HSA eligible health plan may be settling on an HSA provider for their employee HSA. Considerations like fees and user experience are increasingly factoring into the decision, while other aspects of the account like the deposit interest rate can be influential as well.

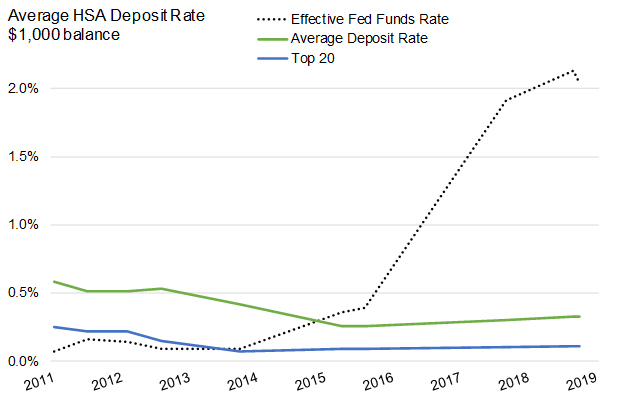

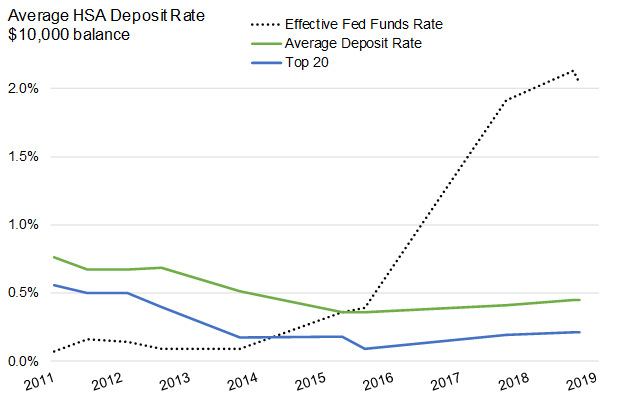

In an effort to understand industry trends, we periodically research publicly listed interest rates offered by HSA providers. Recent averages suggest providers may not be feeling much pressure to raise HSA deposit rates, with the largest providers feeling even less pressure as they focus on providing value in other areas.

Source: Devenir Research, FRED Economic Database

HSA providers have kept deposit interest rates on small balances relatively stable while the Federal Reserve has altered the fed funds rate. Larger balances have seen more variation compared to smaller balances, albeit small increases.

Source: Devenir Research, FRED Economic Database

We continue to be interested in HSA deposit rates and look forward to sharing new insights!

Note: Data above represents Devenir’s assessment on readily available public data, for specific interest rates that apply to your HSA, please contact your HSA provider.