Over the past couple months, a lot of attention has been given to economy as it starts to recover from the COVID-19 pandemic. On Tuesday, July 14th, the U.S. Bureau of Labor Statistics reported an increase in the consumer price index (CPI) of 5.4%, from June 2020 to June 2021. These higher-than-average inflation rates has led to increased pressure on the Federal Reserve to respond. Federal Reserve chairman Jerome Powell testified before congress that he expects inflation to ease near the end of this year. However, he explained that we may continue to see higher levels in the near-term as supply shortages and increased demand remain in many parts of the economy. Chairman Powell explained that they will continually monitor the health of the economy and will adjust their current monetary policy stance if needed.

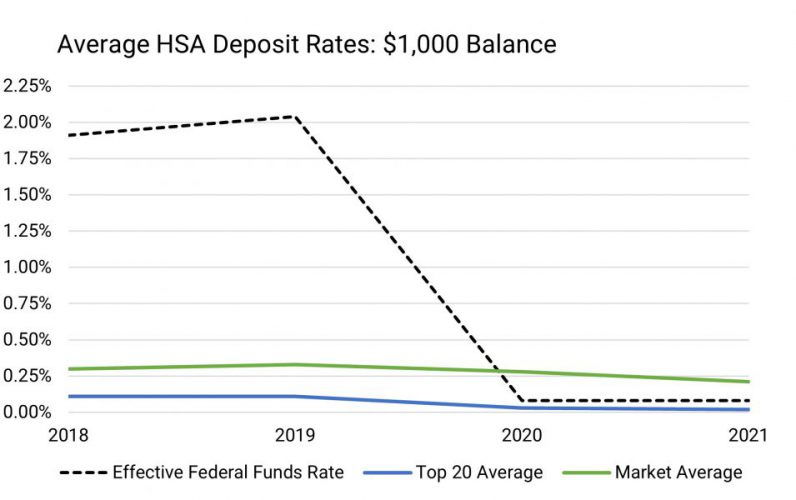

Source: Devenir Research, FRED Economic Database

.

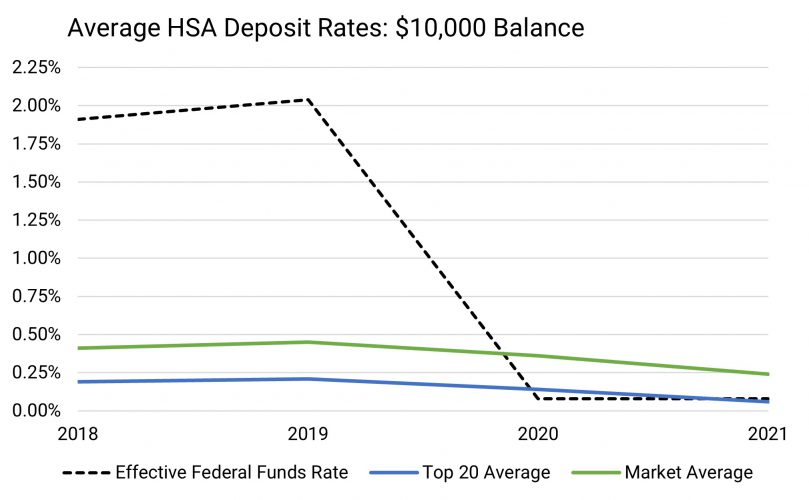

So far, without any change in activity from the Federal Reserve, Devenir has not seen any dramatic impact on deposit rates offered in health savings accounts. Since our last update in February, we have observed a market average decline of two-basis points for accounts with $1,000 and a four-basis point decrease for accounts with $10,000. Deposit rates are often paid out based on the accountholders balance with some providers offering different tiers with higher balance accounts getting paid a higher annual percentage yield (APY) generally. We observed that one balance tier (same interest rate paid regardless of the balance) was the most common with 38% of providers offering one APY. Furthermore, 23% of providers offered two tiers and 18% offered three. The maximum number of tiers that we observed in the market was only offered by one provider with seven different APY’s

Source: Devenir Research, FRED Economic Database

.

We at Devenir will continue to monitor HSA deposit rates and we look forward to publishing more insights. If you are looking for a way to potentially provide your accountholders with a higher yield contact [email protected] to learn about our HSA investment solutions. Also, subscribe to our newsletter below for more HSA industry news and analysis!

Note: Data above represents Devenir’s assessment on readily available public data. For specific interest rates that apply to your HSA, please contact your HSA provider.