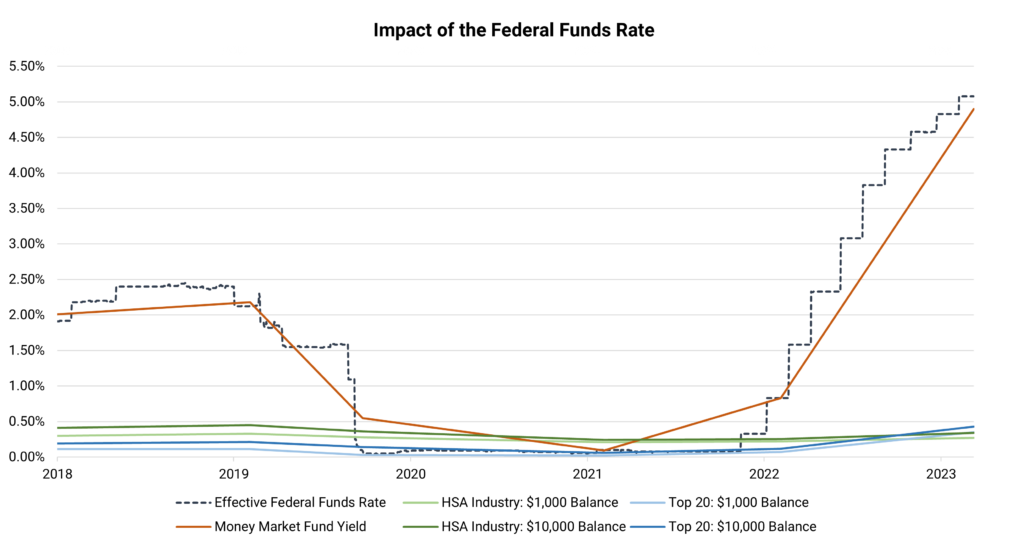

A lot has changed since we last wrote about HSA deposit rates. Inflation proved to be higher and stickier than Fed officials had previously thought, leading to the most aggressive rate hiking cycle in decades. The Fed raised the federal funds rate 10 consecutive times from March 2022 through May 2023 for a total of 500 basis points. This rattled equity and bond markets and eventually played a role in three of the largest bank failures in US history, each occurring within the last few months. The federal funds rate currently sits in the range of 5.00% – 5.25% and Fed chairman Jerome Powell has reiterated that they are strongly committed to bringing inflation down to their 2% target and will remain data-dependent when it comes to future rate decisions. Members of the Fed have signaled that additional rate hikes may be needed in the future after leaving rates unchanged in their last meeting.

Source: Devenir Research

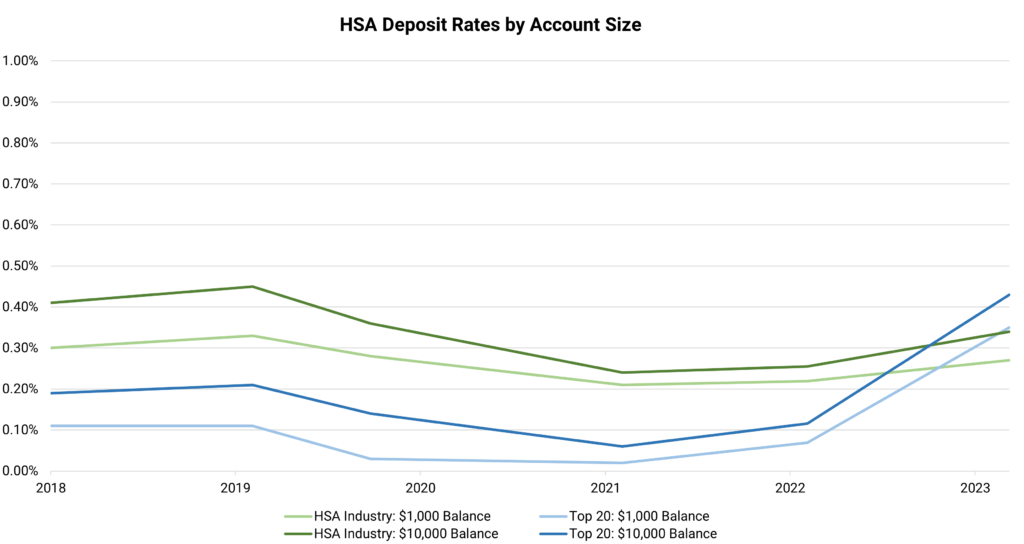

So how has this impacted HSA deposit rates across the industry? HSA providers often have tiered rate schedules where higher balance accounts are offered higher rates. As a result, the effective annual percentage yield (APY) received by an accountholder is typically a blended APY. At the $1,000 balance threshold, HSA providers are paying an average rate of 0.27% as of May 31st, 2023, an increase of 6 basis points since June 2021. At $10,000, the average rate providers are paying is 0.34%, up 10 basis points from June 2021.

Source: Devenir Research

Investors who prefer to keep their HSA assets in cash or a cash equivalent might use a money market fund either as an alternative or in addition to the deposit account, so we wanted to look into money market fund yields as well. Money market fund yields are largely driven by the federal funds rate and have risen sharply over the past year. As of the end of April, the asset-weighted seven-day yield of government money market funds was 4.90%1. These higher yields, along with volatile markets and economic uncertainty, have likely been a big reason why investors have poured nearly $520 billion into money market funds in the first four months of 2023, a 10% increase in total assets invested in money market funds since the end of 20221. However, it’s important to note that money market funds are not FDIC-insured, whereas HSA deposit accounts typically are.

It will be interesting to see where rates go from here now that it appears that we are near the tail end of the rate hiking cycle. We will continue to monitor HSA deposit rates throughout the industry and look forward to sharing any insights.

Note: Data above represents Devenir’s assessment of readily available public data. For specific interest rates that apply to your HSA, please contact your HSA provider.

References

- U.S Securities and Exchange Commission. 2023. “Money Market Fund Statistics”.

https://www.sec.gov/files/mmf-statistics-2023-04.pdf