HSA investments have grown rapidly in recent years, reaching 24% of total assets and over 1.2 million (4%) accounts as of 12/31/2019. The average investment balance for investment account holders has grown to $12,695 in 2019, from roughly $5,000 in 2011.

When it comes to investing, HSA account holders generally have the option to choose from a list of pre-selected mutual funds, however, some HSAs allow for investment in a linked self-directed brokerage (SDB) option (allowing investment in individual securities).

Balances

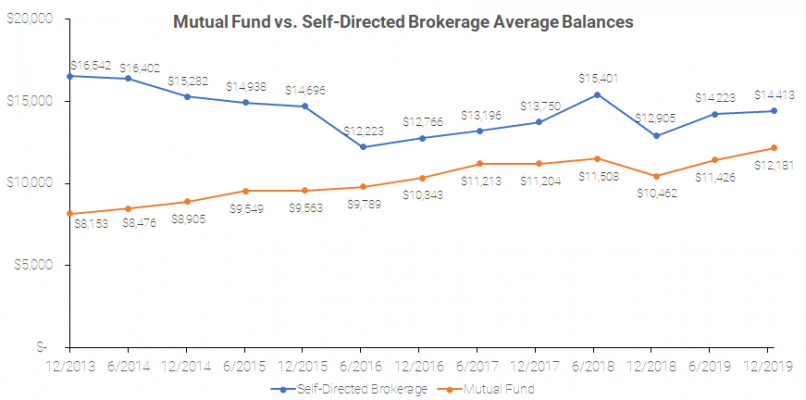

While we find that self-directed brokerage accounts have historically held larger balances on average, mutual fund accounts are growing more rapidly. In addition, self-directed brokerage accounts have had greater variability in average balance over time. This has led to a slow convergence in average balances across both account types.

Holdings

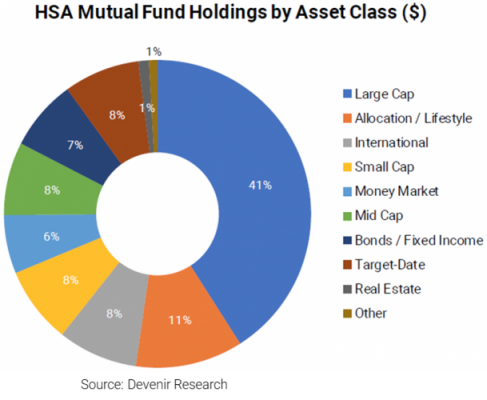

Mutual Fund Programs: Mutual fund programs hold a variety of different asset classes consisting primarily of equity funds (65% of mutual fund assets), followed by multi-asset funds which include allocation and target-date funds (11% and 8% respectively), and fixed income (7%).

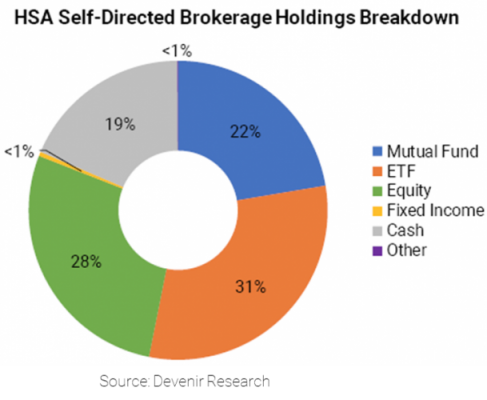

Self-Directed Brokerage Accounts: Self-directed brokerage accounts tend to hold ETFs (31% of SDB assets), individual equities (28%) and mutual funds (22%) as well as a significant cash position (19%). Account holders in SDB accounts interestingly invest very little in individual bond securities, however they may utilize ETFs or mutual funds for fixed-income allocations not shown here.

We highlight several themes to consider when examining the potential attributes of self-directed brokerage and mutual fund accounts:

- Utilization of individual securities within SDB accounts,

- Relatively high cash balances in SDB accounts,

- Level of mutual fund allocations in SDB accounts (potentially higher fees when used in SDB due to inability to obtain better share classes), and lastly

- Target-date fund utilization in mutual funds (designed for retirement accounts).

As self-directed brokerage accounts tend to offer the potential for taking greater investment risk, providers have been creative in providing access to the SDB option. One potential way providers limit the use of SDB by less experienced investors is to require account holders to meet certain criteria before allowing SDB access, such as maintaining a certain balance threshold. Providers may also place restrictions on the types of securities available. As investing in HSAs grows increasingly mainstream, HSA providers must continue to evaluate the effectiveness of their investment model as it relates to the investment outcomes of their account holders.

Investments are not FDIC Insured and may lose value. The information above is intended to be used for educational purposes only and is not to be construed as investment or tax advice, or as tailored to any specific investor. Consult a financial advisor or tax professional for more information. Data used may be estimates and may not reflect actual observed data.