As health savings accounts (HSAs) continue to grow in popularity and the number of accounts steadily increases (see Devenir’s 2020 HSA Year End Research Report), financial institutions are starting to realize the full value of these accounts. However, as the HSA market becomes more competitive, providers must find new ways to differentiate themselves and provide value to their account holders. One way that institutions can help account holders take full advantage of their HSAs is to offer investments.

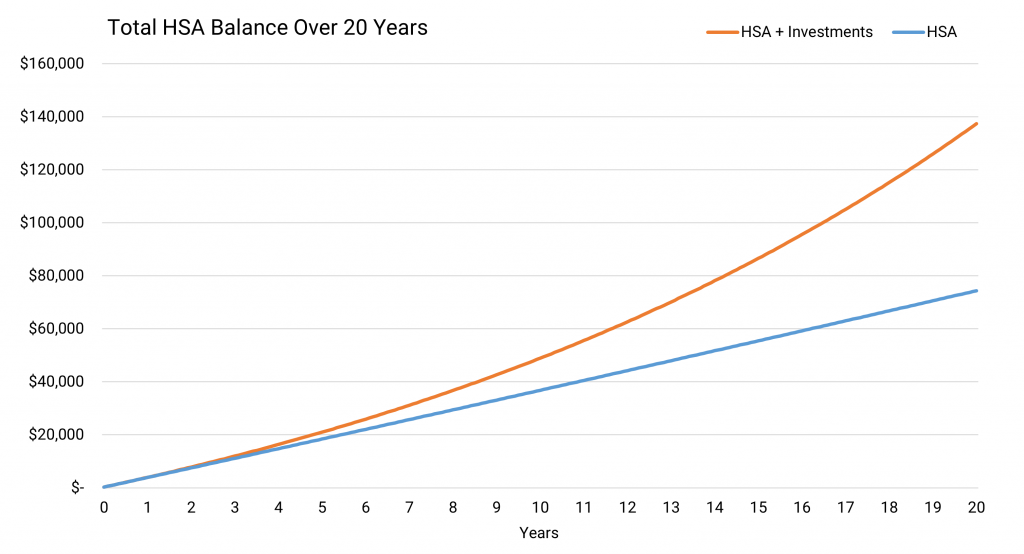

Adding investments allows account holders to potentially maximize their tax savings, earn more on their unused dollars, and potentially build a larger nest egg for health care expenses in retirement. For example, if a 30-year-old made a $300 monthly contribution to their HSA, at 50 years old they would have saved around $74,000. However, assuming an average market return of 6%, per year and an investment threshold of $1,000, if that same individual had invested their HSA dollars, they would have saved around $137,000 by age 50. That is a $63,000 dollar difference!

Scenario above assumes a 6% annual ROR for investments, market average interest rates on the HSA balance, and an investment threshold of $1,000.

Finally, providing an investment solution may create a stronger, and longer relationship with the account holder by providing all the possible resources for them to take full advantage of their HSA. While providing investments is clearly a benefit to account holders, Devenir currently estimates that under 5% of HSA providers offer access to mutual funds or a brokerage account. If you are ready to differentiate your HSA offering and provide your account holders with one of the most powerful tools to save for future health care expenses, contact Devenir at [email protected], or subscribe to our newsletter to learn more.

Investments are not FDIC/NCUA Insured and may lose value. The information above is intended to be used for educational purposes only and is not to be construed as investment or tax advice, or as tailored to any specific investor. Consult a financial advisor or tax professional for more information.