The majority of this report was derived from the 2023 Year-End Devenir HSA Market Survey. This survey was conducted to shed light on the rapidly growing and evolving health savings account market. The survey was carried out in early 2024, with data requested for the period ending on December 31st, 2023.

Key Findings

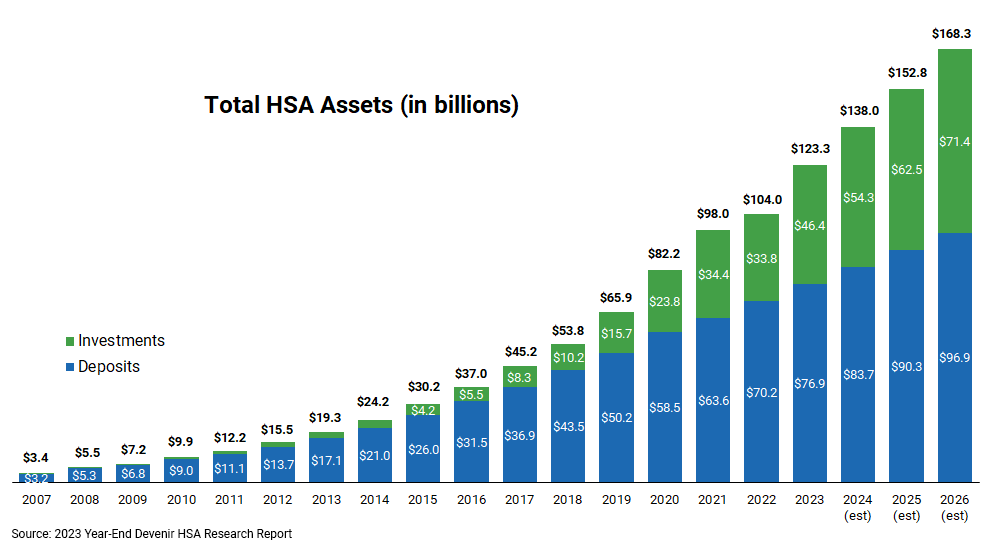

- Strong asset growth. Supported by stock market tailwinds, HSA assets saw record growth during 2023. Growth in the number of HSAs slowed. At the end of 2023, there were $123 billion in HSA assets held in over 37 million accounts, a year-over-year increase of 19% for assets and 5% for accounts.

- HSA investment assets continue to rebound. After enduring one of the worst stock markets in decades during the first half of 2022, HSA investment assets have seen rapid growth. During 2023 HSA investment assets grew 37%, totaling $46 billion at the end of the year.

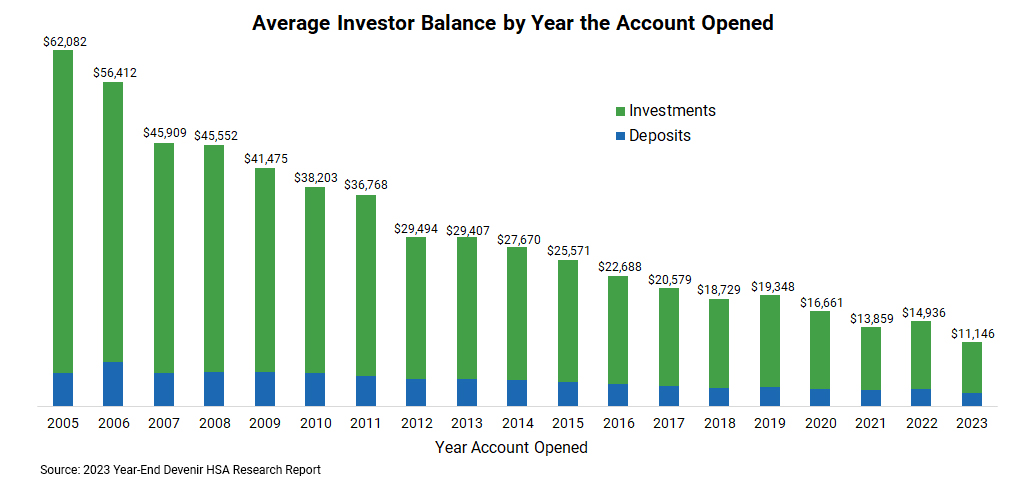

- Growth of HSA accounts investing remains steady. The number of HSAs investing continues to grow but the rapid growth seen over the last few years has slowed. About 2.9 million HSAs, representing almost 8% of all accounts, have at least a portion of their HSA dollars invested.

- Increase in withdrawal activity. Account holders contributed $50 billion to their accounts in 2023 (up 7% from the year prior) and withdrew $39 billion from their accounts during 2023 (up 13% from year prior).

Devenir currently projects that the HSA market will approach 44 million accounts by the end of 2026, holding $168 billion in assets.