MINNEAPOLIS (March 23, 2022) – Devenir, a national leader in providing investment solutions for health savings accounts (HSAs), released today the results of its 23rd semi-annual health savings account survey and resulting research report. Devenir found that there is now over $100 billion saved in over 33 million HSAs at the end of January 2022.

The survey data was primarily collected in January of 2022 for the period ending on December 31st, 2021.

“Over the past 11 years healthcare consumers have contributed almost $300 billion to their HSAs, used their HSA to pay for over $200 billion in medical expenses, and have now accumulated over $100 billion in savings for future medical expenses. HSAs have established themselves as an important tool to help consumers navigate healthcare costs, both now and in retirement,” said Jon Robb, SVP of research and technology at Devenir.

Key findings from the Devenir 2021 Year-End HSA Survey and resulting research report:

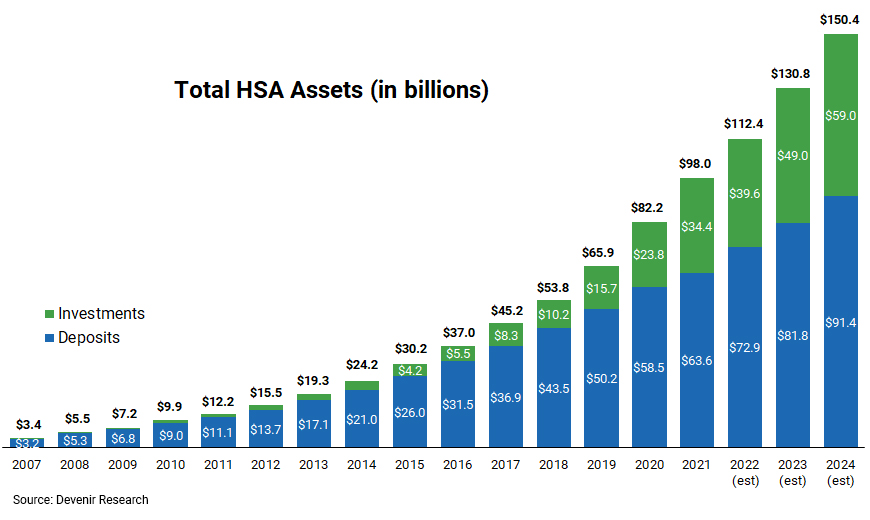

- Healthy growth in HSA assets. Driven by robust investment growth, health savings accounts grew to $98.0 billion in assets held in over 32 million accounts, a year-over-year increase of 19% for assets and 8% for health savings accounts for the period ending December 31st, 2021.

- Strong HSA investment asset growth. With a growing base of investors and continued strong market gains, HSA investment assets rose to an estimated $34.4 billion at the end of the year, up 45% year-over-year. On average, investment account holders have a $19,224 total balance (deposits and investments combined).

- Participation in HSA investing increases. Over 2 million health savings accounts have at least a portion of their HSA dollars invested, representing over 7% of all accounts.

- HSA contribution and withdrawal growth remains muted. Account holders contributed over $42 billion to their accounts in 2021 (up 2% from the year prior) and withdrew almost $31 billion from their accounts in 2021 (up 2% from year prior).

“We always knew HSA assets would hit $100 billion and it’s encouraging to see it occur in January of 2022, consistent with our prior estimates of the 2022 timeframe,” said Eric Remjeske, President at Devenir.

Devenir currently projects that the HSA market will reach 38 million accounts by the end of 2024, holding $150 billion in assets.

Click here to view the Executive Summary

Projections derived from 2021 Year-End Devenir HSA survey, press releases, previous market research, and market growth rates. Projections are barring any regulatory or market environment changes.

Forward-looking statements are based on current expectations and assumptions based on historical growth, the economy, other future conditions and forecasts of future events, circumstances, and results.

About Devenir

Devenir is a national leader in providing customized investment solutions for HSAs and the consumer directed health care market. When health savings accounts first emerged in 2004, Devenir built its expertise around delivering cutting-edge investment solutions. As the consumer driven health care industry grew, so did Devenir’s reputation as a leading researcher and award-winning investment consultant. Today, Devenir continues to lead the way in the rapidly growing HSA market. A research driven perspective makes Devenir the go-to investment advisor, HSA investment platform and consultant to employers, banks, third party administrators, health plans and technology providers. Learn more at devenir.com.

Contact

Devenir

Eric Remjeske

952-446-7400

[email protected]